There are five (5) key questions that must be answered before making a decision to do your own bookkeeping versus hiring a professional:

- How big is your business?

- What is its growth forecast?

- How complex are its finances?

- What can your business afford?

- Are you competent and knowledgeable enough in this field to handle your own bookkeeping?

If you can answer the abovementioned questions honestly, your decision should be much easier to make. So, weigh the pros and cons of doing your own bookkeeping and make your decision.

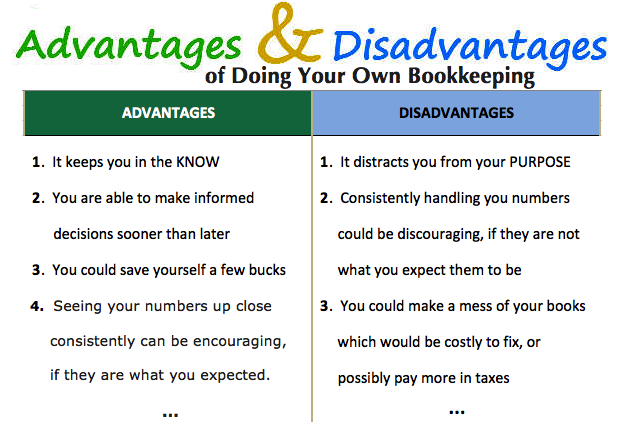

If you are using a bookkeeping and accounting software such as QuickBooks, and you have a basic understanding of accounting principles as well as a CPA on board, you can indeed opt to get your own bookkeeping done. Also, bookkeeping can be time-consuming, but if you are equipped with the right accounting tools and knowledge, your bookkeeping time can be greatly reduced. Here are some advantages and disadvantages of doing your own bookkeeping:

Advantages

1) You are face to face with your numbers all the time, and as such you remain “in the know” and are able to make changes quickly – if necessary, to improve your business bottom line. Of course an efficient and knowledgeable bookkeeper will be able to give you reports explaining your business stance; however, it will not be the same as you intermingling with your numbers on a daily basis. You will make better business decisions because you always know where you stand financially. At any given time, you know who owes you money as well as what bills you need to pay. If a supplier or vendor has made an error you can act on it immediately instead of weeks or months when your bookkeeper brings it to your attention.

2) You are able to make informed decisions sooner than later. Doing your own bookkeeping gives you better control over your business dealings.

3) You could save yourself a few bucks.

4) Seeing your numbers up close consistently can be very encouraging if they are what you expected, or even better.

Disadvantages

1) Bookkeeping can be a real distraction to your business’ main purpose. You take time away from important business dealings that could be enhancing and improving your business bottom line. Bookkeeping is very time consuming and it happens to be one of those back-office tasks that can be done by someone else. Taking on the behind-the-scenes task of bookkeeping may not be the best use of your time. You can instead use this time to innovate, focus on making your product or service better, and grow your customer base. A huge part of a business success is maximizing its time.

2) If you do not have bookkeeping and accounting knowledge, you can make a mess of your books which can be costly – either to hire a professional to fix it, or you’ll pay too much in taxes. Bookkeeping and accounting can be learned; however, it is likely that you do not have the time to spend educating yourself on accounting basics o probably don’t want to. You would also need to master an accounting software which could turn into a very time consuming task.

3) Seeing your numbers up close consistently may be discouraging if they are not what you expected them to be.

Should You Do Your Own Bookkeeping?

Ultimately, the decision will be determined by how valuable your time is to you as well as your answers to the abovementioned questions. Be strategic in how you spend your time and money! Focus your time and energy on the areas of your business that you are truly passionate about. If bookkeeping and accounting is not a part of that passion, you can always delegate your bookkeeping. Maximize your time, and realize your business’ full potential!

The opportunity to do one’s own bookkeeping has increased in the early 21st century thanks to the emergence and evolution of online accounting software programs. However, before one dive into one of these to do their own bookkeeping, they should consider the advantages and disadvantages relative to hiring a professional to do the work for them. Complications can arise, and small business owners “doing it themselves” may also expose themselves to business liabilities.

Indeed it has, Jeremy! Business owners wanting to do their own bookkeeping should take the time to know the basics of accounting before diving in. It could only help. Thanks for sharing!

“Make a mess of your book” I did that! Thankfully, it was only internal and my CPA got to it before tax authorities. Yes, I had to paaaay to correct it, but it did not get to the tax agencies which could require some form of amendment with really huge changes that could possibly prompt an audit. Wow! Shoot! Breathe! My advice, just make sure you get the proper setup and training so you “know” what you are doing – not “think you know” what you are doing – like I did!

Hello Janice, good for you, you had a CPA close by to give you the heads up! Some things were just not adding up to your CPA and prompts him to look into it, it does work like that sometimes, but there are times when it will all seems ok and hard for the CPA to catch. And so, for this reason alone, it is imperative for “do-it-yourself” business owners to get the knowledge and right setup in order to maintain accurate books.

Bookkeeping is not an easy task and required skills to be done effectively. So, outsourcing is a better option, I think.